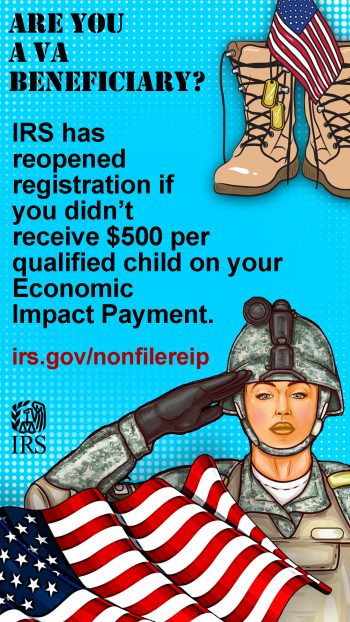

IRS Reopens Registration for Economic Impact Payment for Veterans Beneficiaries Who Didn’t Receive $500 Per Qualified Child

The Internal Revenue Service (IRS) has reopened the registration period for claiming an Economic Impact Payment. Individuals who receive Social Security, Supplemental Security Income, Railroad Retirement, or certain Veterans benefits – but didn’t receive the $500 payment per child earlier this year – can still file for the $500 payment.

Eligibility

Federal benefit recipients can use the Non-Filers: Enter Payment Info Here tool to get a catch-up payment for a qualifying child if:

- Have not already used the Non-Filers tool to provide information about their qualifying child

- Have not filed their 2019 or 2018 tax return

Social Security, SSI, Railroad Retirement Board beneficiaries, and certain VA recipients who have already used the Non-Filers tool to provide information on children don’t need to take any further action. The IRS will automatically send a payment in October.

How to Apply

Federal benefit recipients can use the Non-Filers: Enter Payment Info Here tool to get a catch-up payment for a qualifying child. The Non-Filers tool is available on IRS.gov in both English and Spanish. Eligible individuals can use the tool until Wednesday, Sept. 30 to enter information about their qualifying children to receive a catch-up $500 payment per child.

What to Expect

Eligible recipients can check the status of their catch-up payment using the Get My Payment tool on IRS.gov. They will also receive another Notice 1444 in the mail after the payment is issued; this notice should be kept with individual tax records. The payment will be issued in October.

Those who received their original Economic Impact Payment by direct deposit will also have any catch-up payment direct deposited to the same account. Others will receive a check.

Those unable to access the Non-Filers tool may file a simplified paper return following the instructions in this FAQ on IRS.gov.

Anyone who misses the Sept. 30 deadline will need to wait until next year and claim the payment as a credit on their 2020 federal income tax return.

Come join NOW over 34,000 VOB Members. Add your business to the Veteran Owned Business Directory and grab one of our Verified Veteran Owned Business or Certified Veteran Owned Business badges for your website!

If your business is (or you know of another business) owned by a veteran (VOB), active duty military, reservist or military spouse of the United States, Army, Air Force, Marines, Navy, Coast Guard or National Guard, please be sure to visit the sign up page to get your membership and business’ profile.

The objective of our FREE Veteran Owned Business Directory is to continue to offer a growing list of products and services that are unique in the fact that they are all owned by, sold by and/or serviced by past and present military members!

Be sure to check out our new national and state Veteran Owned Business Certification and Service Disabled Veteran Owned Business (SDVOSB) section or our VOB/SDVOSB Certifications by State.